Tax season is officially underway, so it’s the perfect time to gather your documents and prepare for a smooth filing process. Working with a tax preparation firm like Integrated Tax Services can help ensure accuracy, maximize deductions, and keep you compliant with ever-changing tax laws. Here are a few tips to make working with us easy and stress free:

Organize your documents early

One of the biggest stressors at tax time is scrambling to find necessary paperwork at the last minute, therefore preventing you from getting in our queue so we may start working on your return. Avoid the crunch by collecting and organizing your documents early. Key items to gather include:

- W-2s and 1099s for income reporting

- Statements for investment earnings (1099-DIV, 1099-INT, 1099-B)

- Retirement account contributions and distributions (1099-R, IRA statements)

- Mortgage interest statements (Form 1098)

- Student loan interest (Form 1098-E)

- Property tax payments

- Charitable donation receipts

- Medical expense records

- Business income and expenses if self-employed

Use technology for easy interaction

The easiest, fastest, and most secure way to get your documents to us is through NetClient CS, our online portal. You simply upload all necessary information, and we take it from there to do your return. If you haven’t registered for NetClient CS and need an invite to join, please email us.

Understand completion timelines

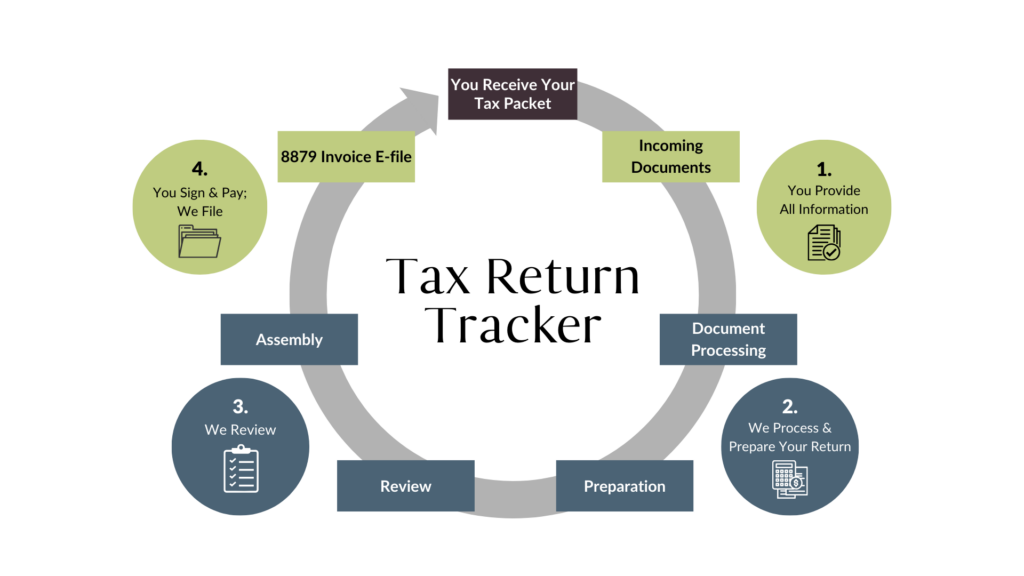

Tax Day is Tuesday, April 15, 2025. Each return takes 4‐6 weeks to fully prepare, review, assemble and file. Providing us with your documents as soon as you receive them is important, as it allows us time to get you into our queue, understand your specific situation, and prepare and file your tax return. See our Tax Return Tracker below that walks through the steps for each tax return that comes through our office.

Don’t be afraid of filing for extension

When we file an extension for filing your tax return, it may seem concerning, but it’s actually a common practice and can work in your favor. Here’s why:

- Filing an extension on your tax return gives us more time to review your financial documents thoroughly. We want to avoid any errors or missed deductions that could result in higher taxes or even an audit. By taking extra time, we can ensure everything is accurate and that you’re maximizing your tax savings.

- Requesting an extension gives you extra time to submit your return without facing late filing penalties. However, this extension doesn’t give you more time to pay any taxes you owe. To avoid penalties, it’s important to pay any owed taxes by the original deadline. If you don’t file your return or request an extension on time, the IRS may charge a failure-to-file penalty, which can be more expensive than the interest on any unpaid taxes.

As a precaution, our firm automatically files extensions for tax returns not filed by March 1. We do this to ensure we are taking care of everyone. If we receive all your documents by March 1, we’ll likely complete your return before the deadline. We’ll guide you through the extension process to ensure it’s straightforward and hassle-free.